INCOME & EXPENSE REPORT:

April 2022

This is our very first Income and Expense Report for Every Further Mile!

We plan to update you monthly until our channel produces $100,000 in revenue in one month (crazy goal…I know!), giving you a look behind the curtain of a recently started Youtube channel. (https://www.youtube.com/everyfurthermile)

These reports will:

- Give you a sense of what it costs to travel full time as a family

- Assist you in avoiding costly mistakes

- Educate you on how you can make full time travel a reality

a. How to have the $$ to do it

b. How to get started

In these reports you will find detailed breakdowns about our income (as we grow our online business) and our expenses (business and travel related).

*All currency unless otherwise stated is in Canadian Dollars.

You won’t see a detailed breakdown of our personal costs which might include medical expenses, tax returns, donations we make, bank fees, toy purchases, etc… anything that we want to keep private and the stuff we don’t think you’ll care about.

INDEX:

1. Income Report

2. Expense Report

3. Our 5 Most Costly Mistakes

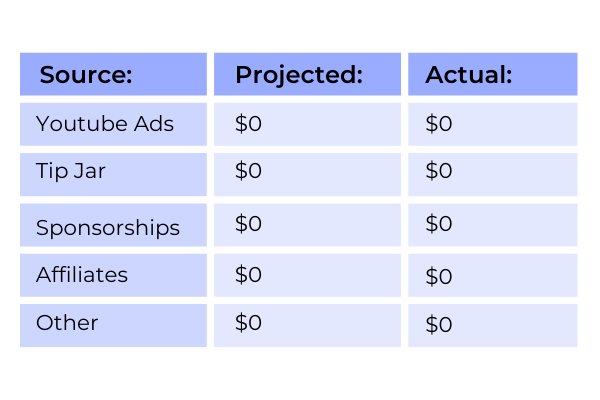

Income Report (April 1st to 30th, 2022)

We actually don’t have any income to report for April as we’ve just started our Youtube channel and have not yet been monetized. So in lieu of breaking down our income we will instead be talking about our road to monetization.

We plan to use multiple sources to build our revenue:

- Youtube Ad Revenue

In order to be monetized on Youtube you need to meet 4 criteria on Youtube

- You need to complete the 2-Step Verification on your channel

- You need to not have active community guideline strikes

- You need 1000 subscribers in a 365 day period

- You need 4000 public watch hours in a 365 day period

Once you’re monetized Youtube will begin profit sharing on the ads they place in your videos. This means that you will make a percentage of the profit they do based on whether your audience watches the ads, how much they watch, what niche you are in and where your audience is located. According to InfluencerMarketingHub.com “a YouTube channel (on average) can receive $18 per 1,000 ad views, which equates to $3 – $5 per 1000 video views.”

This means it will almost certainly take quite a while to make money on a Youtube channel. Although if you’re one of the lucky few a viral video with 5 million views could pay approximately $90,000 if the average above is correct.

By the end of April we were at 60% of our Subscribers and Watch Hours to reach monetization. As of April 30th our Youtube Subscribers were 610 and we had 3000 Public Watch Time Hours.

Help us reach our goals by subscribing to our channel here: https://www.youtube.com/everyfurthermile

- Paypal TipJar

We have a ‘tip jar’ on our Youtube Channel but we have not drawn any attention to it and it’s buried deep in our video descriptions so that few people will ever notice it. In the future we may draw more attention to it, but for now it’s not really generating any money.

- Sponsorships

Being a very small channel we aren’t really in a position to attract sponsors yet. Sponsorships usually are the most lucrative part of a Influencers income, especially in that awkward middle stage of growth. When a sponsor does eventually reach out we will certainly make sure that what they are offering is in line with our personal values and suits the tone and theme of our channel.

- Affiliates

We do have some affiliate relationships, but like our ‘Tip Jar’ the links are buried deep in our video description and we do not draw much attention to them. As we grow, we plan to utilize these sources of income more.

Note: We would never…ever… suggest something unless we’ve used it ourselves and think it’s a good product.

Trusted House Sitters: $0

We use this to get free stays while helping take care of people’s pets and homes. We have been able to secure 8 weeks free accommodations across the UK (in the middle of summer!). 3 Weeks of this was in Edinburgh, 2.5 in York, and 2.5 in the English countryside. That’s 8 weeks that we don’t need to pay for accommodations and get to enjoy the UK.

We’ve created a guide & templates to help get you started on Trusted House Sitters. You can find it HERE.

Here’s a link to get started on THS!

Tube Buddy: $0

A tool used for Youtube SEO:

https://www.tubebuddy.com/EveryFurtherMile

Epidemic Sound: $0

A tool used for royalty-free music in our videos (so that we don’t get sued for the music we use)

(Free 30-day trial): https://www.epidemicsound.com/referral/te7jhr/

Amazon Affiliates: $0

For products we’ve bought that help us travel or do our videos.

Sony ZV-1 (https://amzn.to/3tsbIZ8)

- Other Income Sources

Once our social media accounts grow to an adequate size we can leverage them for more Income Source such as courses, promotions,

Facebook Likes 1170, we would need this page to grow to a minimum of 10,000 likes https://www.facebook.com/everyfurthermile

Instagram Followers 219 , we would need to gain a minimum of 20,000 followers https://www.instagram.com/everyfurthermile

INCOME NOTES:

- We can start to make money at 1000 subs/4000 watch hours (albeit minimal)

- We suspect that once we hit 10,000 subs+, we’ll be able to start our ‘micro influencer’ journey to making more money through sponsors, etc.

So how are we doing all this travel with no income?

We sold most of our worldly possessions including our house in Canada in order to launch our youtube channel. We plan to leverage these savings to launch our influencer business while also fulfilling a decade long dream.

Expense Report (April 1st to 30th, 2022)

I wish we could say that we don’t have any expenses to report but sadly, travel costs money. We are a family of 4, so keep that in mind as you see our expenses. If you’re a single or couple, then you should be able to cut these expenses significantly.

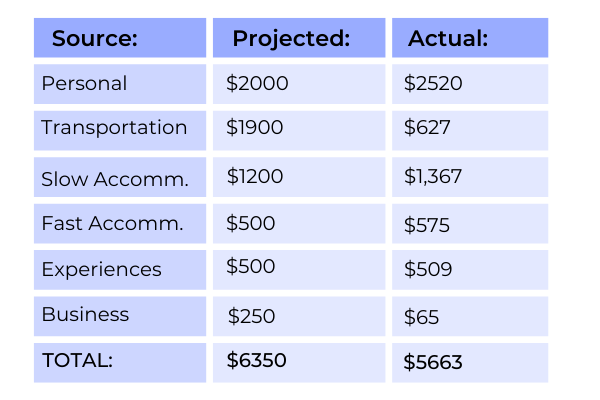

Projected vs Actual Expenses: $6,350 (Projected) vs $5,663 (Actual)

First, we want to discuss our projected expenses vs. our actual expenses. Oftentimes these two don’t add up. This can be because of yearly expenses (memberships often do this), deferred expenses (Paying for a monthly airbnb at the end of your stay), upfront expenses (paying for a ticket well before you see the experience), and so on. So even though projected and actual monthly budgets may not add up, it is important that they balance out over the year.

Our projected monthly expenses are 6,150 a month. Our actual expenses for April were $5,863 which sounds good at first but is definitely not. We have not had any flights this month and our car rental isn’t paid until June. We need to consistently come under budget by about $2000 so that on the months with international flights and car payments we don’t push the yearly actual budget past the projected budget of approx. $66,000. We’ll talk more about why/how we over spent in the breakdowns.

Personal Expenses – $2520 Actual vs. $2000 Budgeted

Our personal expenses include $800 for groceries, $500 for meals, $200 for travel insurance and another $500 misc. Miscellaneous includes things such as entertainment subscriptions, cell phones, gifts, clothing, and homeschooling resources. Lastly, our expenses in April also include some expensive items related to our house sale, so that is not helping us much. 🙂

Transportation – $627 Actual vs. $1900 Budgeted

Transportation is all the costs associated with getting around between cities and in cities. This includes plane flights, car rentals, taxis, ubers, buses, metros, trains, fuel, and car related items. This month’s transportation expenses do not include our car rental, which we’ve already paid $3400 as a deposit and will likely cost us around $1000 after additional kilometers are calculated in June. It does include plenty of fuel which averages about $1.90 euros or $2.65 CAD a litre, or $7.62 USD a gallon. It also includes an enormous amount of Toll road fees and parking.

Slow Travel Accommodations – $1,367 Actual vs. $1200 Budgeted

Slow traveling accommodations are all of the expenses related to our monthly stays. This obviously includes rentals but also includes additional expenses such as replacing broken items, paying utility bills, etc… In April we rented an Airbnb property in Castell de Ferro for a month. It cost us just under $1,277 for the month and we were charged a somewhat hidden fee of $90 for electricity.

Lesson learned: Always read the fine print and ask questions before booking on Airbnb. We likely could have fought the $90 fee, but it wasn’t an overly expensive lesson and we would rather not have our own Airbnb reviews be negatively affected by it. The average cost for our 2 bedroom Airbnb apartment on the beach was just under $43 a night.

Fast Travel Accommodations – $575 Actual vs. $500 Budgeted

Fast traveling Accommodations are all of the expenses related to our nightly stays. This includes hotel rooms and airbnb nightly stays. Additional fees for breakfast are included in our Meal expenses. In April we paid for two stays with over 3 nights for just under $575.

Experiences – $509 Actual vs. $500 Budgeted

Experience expenses include entry into historic places, theaters, and other experiences that we get to enjoy for the moment. It does not include any food we buy while there, nor does it include any souvenir items we purchase there. April’s experience expenses included Westminster Abbey, The Cauldron in London, Sagrada Familia, Guell Park, Alhambra in Granada, The Mosque-Cathedral in Cordoba, and a few more.

Business – $65 Actual vs. $250 Budgeted

Business costs for April included just subscription based services, equipment and professional memberships. Our subscription based services include Canva, Epidemic sound, Tubebuddy, Divi Themes, WordPress, and our Hosting Fees. Any computer, camera or other equipment purchases would go here. We budget $150 a month so that we can spend $1800 a year to replace our equipment. Lastly business expenses could include professional memberships in press, media and social media organizations which would in turn allow us ‘press passes’ into events and give us more legitimacy when approaching others about cross promotion and tourism contracts.

Conclusion

So as you can see April 2022 means that we have a shortfall of $5,663 on our first Income and Expense Report. Woo hoo! Here’s hoping we can start making money in the next couple of months and slow down this fast drain of our life savings 😉

(We’ll discuss why we chose to do it this way in future emails.)

Our 5 Most Costly Mistakes

It’s probably no surprise that transportation and accommodations are our most expensive mistakes. They are after all the most expensive part of any trip. Here are our 5 most costly mistakes so that you don’t have to make them.

But let’s start with our most expensive mistake, Too much fast travel cost us $5400

Unsurprisingly we were very excited when we first started out. I hadn’t been abroad for 7 years when we were living in Kuwait and Amanda hadn’t been abroad for 3 when she visited Iceland with a friend. On top of that, all of our previous travel experience was fast travel. Meaning that we have a lot of bad habits to unlearn. For those new to the channel we started fast traveling as soon as we left Nova Scotia to begin our Worldwide Slow Travel Journey. We stopped in Quebec City and Montreal on our way back to Ontario, Canada. We also added a few days in London, England, a few days in Paris, and a stop in Vichy, France, all on our way to Barcelona. There was nothing slow about the start of our slow travel journey.

So when you first start out remember to not to get carried away, slow travel will get you everywhere eventually, so there is no need to try to fit it all in. If we had driven directly to Ontario with only one stop and flown to London and then to Barcelona we could have saved at least $5400.

Our second mistake was that we took the train from London to Paris instead of taking the plane, which cost us an extra $300-$600.

How did we make this mistake? We made the more expensive decision to take the train from London to Paris without really thinking about all the Pro’s and Con’s. We had thought that the train from London to Paris would offer amazing views of the countryside, awe us with the engineering marvel of the Chunnel, and be quite a bit less hectic than airports which are pretty bad all over the world right now. Bu, with proper research we would have realized that the train doesn’t really offer much as far as views go, the lineups are atrocious actually making it worse then the airport, and the Chunnel itself didn’t really seem any different then the average metro ride. All in all, it was more annoying than flying and it cost us at least $300 dollars more.

Our third mistake was that we Rented a car instead of getting a Rail Pass. Now Amanda and I still argue as to whether this was a mistake, but we can both agree that choosing to rent a car cost us an additional $2800.

When deciding whether you want to rent a car be sure to keep in mind ALL the expenses. The rental fees are only one part of it. Don’t forget the Insurance, the additional driver fees, the cost of gas (Get ready for a shock if you’re from America) , additional mileage fees, and the shocking amount of tolls, especially if you are traveling in France which has the most expensive tolls we have ever seen. Alternatively we could have purchased a EURail Pass for $3000 and budgeted an $1500 in additional day trip accommodations.

Before you totally rule out a car, there is a big catch to EURail Pass. You have to lug around your luggage every time you travel, as opposed to having a car that can act as a storage locker between stays.

Our fourth mistake was that we choose AirBnB Bookings that were too remote. So if you have been following us you know that we are a frugal travel family that loves to save money. We tried to save money by booking monthly rentals in small towns that were centrally located. This gave us nicer stays for less money but as it turned out that this was a Penny-Wise and Dollar-Dumb decision because it meant that there was far less to do and we needed to use the car for virtually any day trip.

So after suffering through some of the worst stress of our journey, we’ve really come to realize that rural living really isn’t our thing. That being said we aren’t big city people either. Our comfort zone really is small cities, between 200 and 500 thousand people. We have learned that easy access to vegetarian options at restaurants and grocery stores is a must. We need a few fellow expats to speak with from time to time, and a place where we can get out of the apartment on a daily basis for some sort of activity. We love immersing in another culture but navigating homesickness and stress is easier in the right conditions.

This mistake didn’t really cost us any money, but it also didn’t save us the money we thought it would either, which means we suffered through a very difficult time without any real pay-off.

Now for what we feel is our biggest and second most expensive mistake… We joined Trusted House Sitters too late.

If you don’t know what Trusted House Sitters is, let me explain it to you. Trusted House Sitters is a Matchmaking Service for Pet Owners and Pet sitters. It has members all over the world, but the UK is probably one of the more popular locations for owners. It shows owners and sitters potential matches based on location, family dynamics, pet experience, dates and more. It feels a little like AirBnB if AirBnB stays came with responsibilities. We were worried at first that we would have difficulties as a family of four looking for sits but we’ve come to learn that some people prefer families. We have had plenty of great housesits with some very adorable fur babies.

We will spend a few hundred dollars every year on the membership but we will save $1200 a month every time we can find enough long term stays to fill that month. Admittedly, we will spend a few hundred more in accommodations and transportation to get to and from the various house sits, but we have also saved on groceries as most house sits want you to use their perishables before they go bad and of course use of their condiments.

Looking back over the last 4 months of slow travel we realize we could have saved over $10,000 by making decisions a little differently.

We could have fast traveled less and saved $5400, though in a do over we would still have fast traveled about half as much.

We could have flown from London to Barcelona, rather than taking the train and the rental car through France and saved over $1000, and that’s exactly what we would do in the future.

We could have purchased a EURail Pass and saved around $2800, but in the end it may have been worth it for the ease and convenience of having a rental car. We still haven’t decided what we will do moving forward.

We could have chosen AirBnB’s in small to mid-sized cities which wouldn’t have made a big difference in savings but would have saved us a great deal of stress and heartache which is exactly what we plan to do moving forward.

Lastly we could have joined Trusted House Sitters before setting out and saved $1200 a month and used House Sitting opportunities to help us decide where to stay in the world.

If that is something you would be interested in trying feel free to use the link in our video description and the comment section below. Just a heads up though, it is an affiliate link so if you choose to go ahead with a membership we will get some sort of commission. We would definitely recommend it for any animal lover with or without commission. We would have recommended Trusted House Sitters just based on the money savings alone but we want to add that the quality of houses we have stayed at thus far, are a great deal better than what we could afford with our $1200 a month Airbnb budget. Our first House Sit was set up with lots of toys and spaces for the boys as well as a hot tub. Our Second stay is a luxury apartment in the Heart of Edinburgh, and both places would have cost us well over $5000 a month on AirBnB.

Keep Joining us… Every Further Mile!

Hey! We’re the crazy Swartz family…aka Every Further Mile! We’re the ones that sold everything to follow our dream of full time travel (after 10 long years of dreaming). And now we’re here to help you fulfill your dream by exposing all our foibles (that word is just isn’t used enough), lessons learned and the money needed to make it happen.

We’re SO happy you’re here!

Disclaimer: The products/services we suggest are all ones that we have used and support. The links used may be affiliate links, which means we receive some compensation for your purchase through those links. If you decide to buy one of our recommended products/services, know that you also support us if you use our links.

Also, these suggestions are our opinion based on our experience. Your experience could differ to ours. These reports are meant to give you an idea of what to expect if you start to travel, but aren’t definitive numbers/experiences.